How well or poorly insured are Belgians whizzing down the ski slopes?

One in two Belgians go on holiday without travel insurance. They rely on their mandatory health insurance to cover all risks. Nothing could be further from the truth, because it only covers medically necessary care. The risks of a ski vacation are not the same as those of a beach vacation, which means that people need more and different services than regular health insurance offers. This is exactly where an opportunity lies for organizations and companies – the chance to offer consumers the customer experience they are looking for by expanding or innovating products.

Skiing accidents are the most expensive travel mishaps

Figures from the French Association of Mountain Physicians show that repatriation from ski resorts is at peak level.

- Eight out of ten winter sports accidents happen on the slopes.

- In 2018, more than 144000 people were cared for in an accident during their skiing holiday in France.

- Ambulances carried 57500 of them away, while 1450 were taken by helicopter. Another 85050 went to the doctor on their own steam.

- Hospitalizations amounted to 7920 (5.5%).

- And 135000, 94% of those injured, had to end their vacation and return home early.

These types of skiing accidents often end with unpleasant financial consequences, due to admission to a private hospital, unused ski passes, and not being able to use lessons that are often prepaid. An accident outside of the piste is not covered by most insurers, and the victim has to pay the costs for the rescue, the repatriation and the medical costs out of pocket. These uncovered costs quickly add up, e.g. a helicopter can easily cost EUR 4500 per hour. A very bitter pill indeed for those Belgian winter holidaymakers who only rely on their health insurance.

Secure on the piste?

But if you already have travel insurance in addition to your health insurance, does it cover the risks of a winter vacation? The health insurance only covers medical costs and only covers the European Union, Switzerland, Norway, Iceland, Liechtenstein and Australia. Travel insurance often stops at the borders of Europe and does not always cover skiing accidents. How do you ensure that your customers go on a skiing holiday without worries?

Complete insurance for skiers and snowboarders

Today's customer expects added value - certainly from their bank or insurer. And it does not have to be in the digital sphere alone. What's more, the perceived added value often lies in the positive customer experience that a company offers. So, expanding travel insurance for winter sports enthusiasts to suit their ski or snowboard holiday is right on target.

Consider benefits such as reimbursement of unused ski passes and lessons, as well as search and rescue costs, and cover for the 20% of accidents that occur off-piste. Add a 24/7 contact centre to take on the customer's problem, offer him or her comfort and provide support for the stranded winter sports enthusiast until the accident is resolved. For example, the centre can offer advice on whether it is possible to have an operation in a Belgian hospital instead of in the holiday country. Offer him or her a distinctive user experience: peace of mind with a complete and active ski insurance with worldwide cover.

Peace of mind for both traveller and insurer

The customer-ready Ski Assistance insurance from AXA Partners with accompanying assistance service is a comprehensive ski insurance package. You can offer these to your customers under your own name, through our white labelling option – without having to worry about the operational aspect. AXA Partners organizes this according to your quality standards. A win-win situation for insurers and ski fanatics.

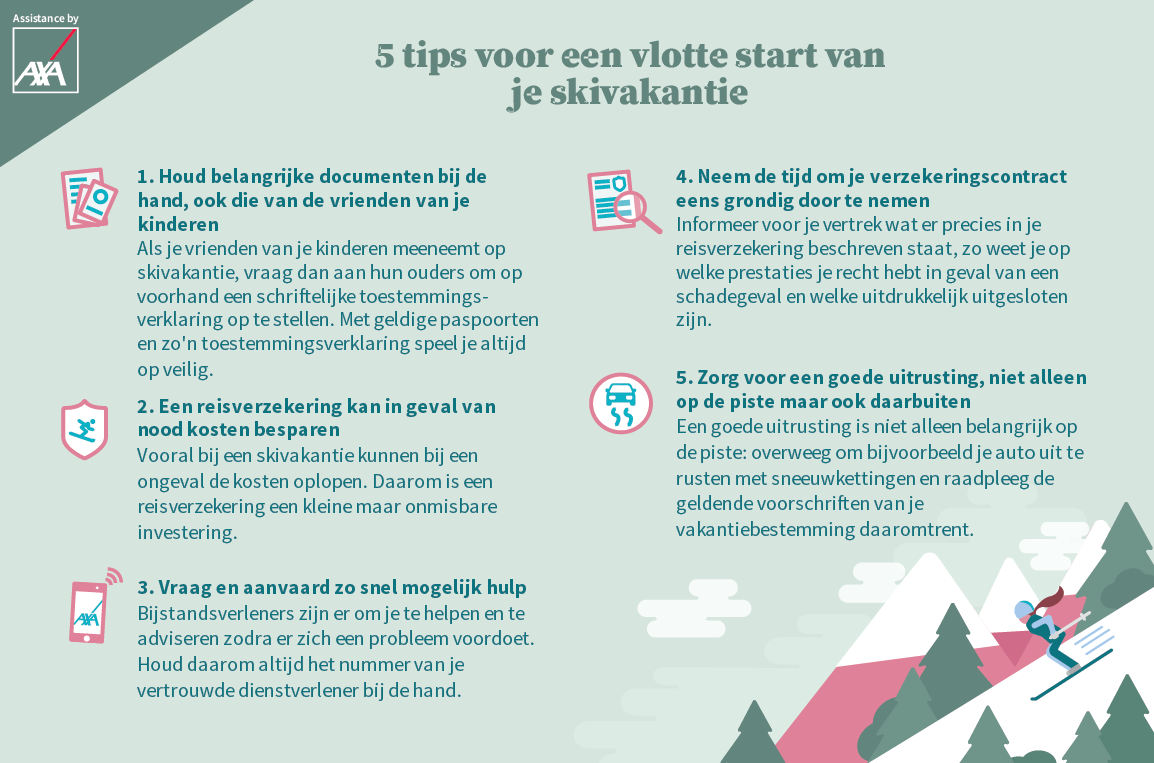

Five tips for a smooth start to your skiing holiday